Trusted By Our Clients To Help Over $2,000,000 in Credits

Receive Up To $26,000/Employee!

Take advantage of the Employee Retention Tax Credit while it's still available!

Get Your ERC Today

Receive Up To $26,000/Employee!

Take advantage of the Employee Retention Tax Credit while it's still available!

Get Your ERC Today

Begin initial eligibility below. See if your business may qualify for up to $26,000 per employee from the Employee Retention Tax Credit (ERC). Start your application and get immediate results.

“We’re getting a $75,000 tax credit. That’s exactly the help we needed to climb out of the downturn.”

- Get Your ERTC Client in Raleigh, NC

Was your business impacted by COVID?

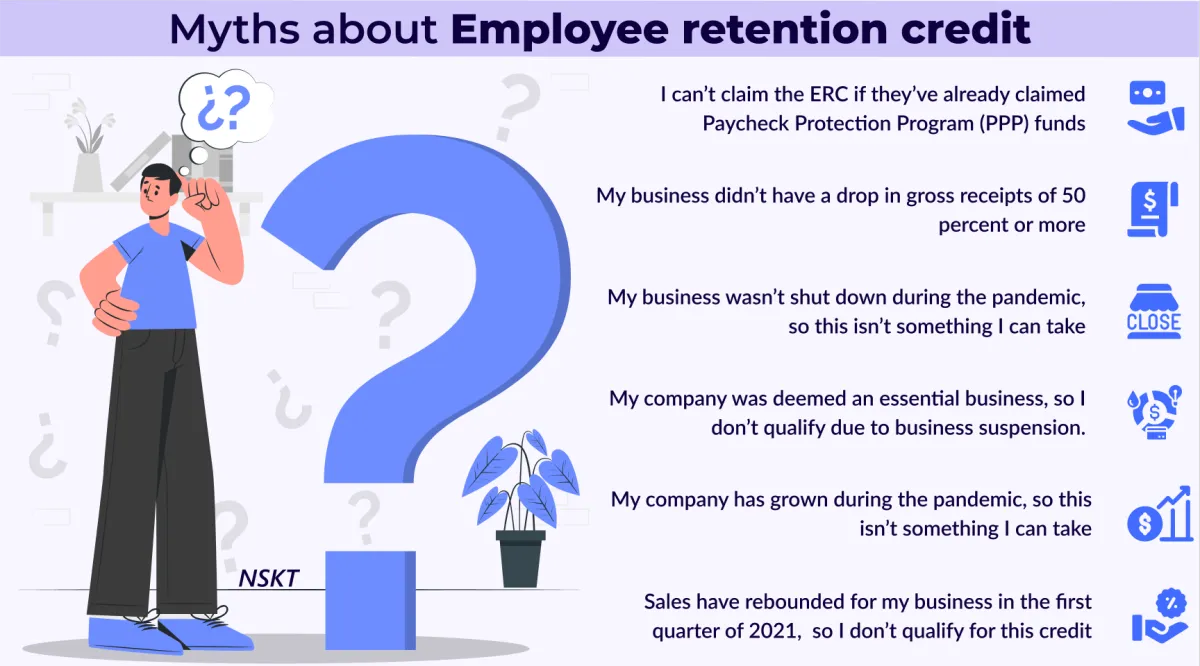

The Employee Retention Tax Credit is the largest business tax credit in our country’s history. Unfortunately, most business owners don’t realize they qualify.

Get Your ERTC has empowered our small business customers to claim more than $300 million in ERTC (and counting).

Let us help you claim your funds. Get started today!

Was your business impacted by COVID?

Quality Service In For Over 20 years

The Employee Retention Tax Credit is the largest business tax credit in our country’s history. Unfortunately, most business owners don’t realize they qualify.

Get Your ERTC has empowered our small business customers to claim more than $300 million in ERTC (and counting).

Let us help you claim your funds. Get started today!

GET YOUR ERC TODAY!

The Employee Retention tax Credit (ERC) is the largest government stimulus program in history. Find out if your business is eligible to receive a grant of up to $26,000 per employee!

See Our Easy Process Below

How It Works

1. Submit Application

Simply provide us with some basic information about your business via the form at the top or bottom of this page.

2. Profile Documentation

Our team will be in contact to discuss your tax credit opportunity and gather the necessary documentation from you.

3. Get Paid

The IRS will process the tax credit and mail you a check. It's that easy, and it will be one of the best decisions you make.

How Much Could You Qualify For?

Get the funds you deserve | SMBs can claim up to $26,000 per employee

2020 Credits

The 2020 CARES Act established an employee retention credit of 50% of $10,000/employee in qualified wages for eligible businesses or $5,000 tax credit per employee. Originally, businesses had a choice between PPP funds or ERTC credits, but not both. Then, on Dec. 27, 2020, the Consolidated Appropriations Act (CAA) modified the CARES Act so that businesses who received PPP loans can now retroactively also participate in ERTC so long as they don’t double-dip and apply for ERTC with payrolls paid with PPP funds.

2021 Credits

The Consolidated Appropriations Act (CAA) passed on December 27, 2020 and extended the ERTC to Q1 and Q2 of 2021 with richer benefits and new eligibility requirements. Then, the American Rescue Plan Act (ARPA) was signed into law on March 11, 2021 and extended ERTC through Q3 and Q4 of 2021. Q4 was later eliminated by The Infrastructure Investment and Jobs Act signed into law on Nov. 15, 2021.

The 2021 credits total 70% of wages up to $10,000 per employee per quarter. The result is a credit up to $7,000 per employee for up to three quarters in 2021 totaling $21,000.

Apply For Your ERC Today!